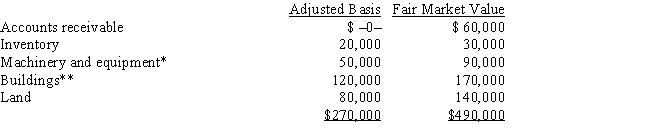

Albert's sole proprietorship owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Demand Schedule

A spreadsheet illustrating how much of a good or service consumers are interested in and can afford to buy at various price points.

Marginal Cost

The increment in total financial outlay associated with generating one more unit of a product or service.

Demand Schedule

A table showing the quantity of a good or service demanded at various prices, depicting the relationship between price and demand.

Monopoly

A Monopoly exists when a specific person or enterprise is the only supplier of a particular commodity, giving them significant control over pricing and market terms.

Q7: An established patient is seen for migraines

Q12: The root operation that is defined as

Q12: Electrocardiogram with 15 leads including the interpretation

Q25: Oxen Corporation incurs the following transactions.<br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5432/.jpg"

Q47: Which of the following statements regarding the

Q60: Ashley has a 65% interest in a

Q86: Mercy Corporation, headquartered in State F, sells

Q96: Distributions of appreciated property by an S

Q144: Mock Corporation converts to S corporation status

Q145: Partnerships<br>A)Usually subject to single taxation even if