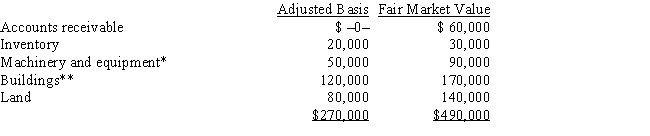

Mr. and Ms. Smith's partnership owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Sales Discounts

Reductions in the amount owed by a customer, usually offered as an incentive for early payment.

Single-Step Income Statement

A simplified income statement that calculates net income by subtracting total expenses from total revenues with a single calculation.

Total Expenses

The sum of all costs and expenses incurred by a business during a specific period of time.

Cost of Goods Sold

The immediate expenses linked to creating products sold by a business, covering both materials and workforce costs.

Q1: Benign neoplasm of the thymus.<br>ICD-10-CM Code: _

Q9: If a taxpayer is required to recapture

Q16: Congenital dislocatable hip.<br>ICD-10-CM Code: _

Q20: To the extent of built-in gain or

Q20: Startup costs<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q23: Which punctuation mark between codes in the

Q33: Medicare and other federal payers do not

Q87: Fred and Ella are going to establish

Q92: Krebs, Inc., a U.S. corporation, operates an

Q104: A "U.S. shareholder" for purposes of CFC