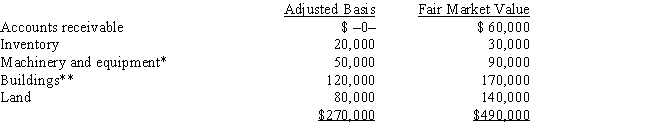

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Q14: The Section 179 expense deduction is a

Q18: Typically, sales/use taxes constitute about 20 percent

Q19: When the reason for the encounter is

Q33: An S corporation with substantial AEP records

Q45: A taxpayer who expenses circulation expenditures in

Q47: Which of the following statements regarding the

Q64: Sickle-cell anemia.<br>ICD-10-CM Code: _

Q76: When loss assets are distributed by an

Q90: A limited partnership can indirectly avoid unlimited

Q159: Arnold purchases a building for $750,000 which