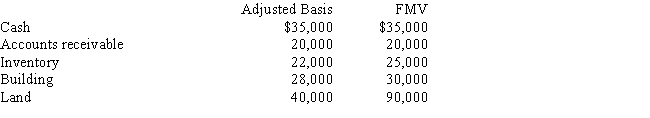

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of Vireo, Inc., are as follows:

Lee sells his stock to Katrina for $300,000.

a.Determine the tax consequences to Lee.

b.Determine the tax consequences to Katrina.

c.Determine the tax consequences to Vireo, Inc.

Definitions:

MBA Degree

A Master of Business Administration degree, a graduate-level degree focusing on business management and practices.

Strategic Thinking

The ability to plan for the future with a long-term perspective, considering various scenarios and potential outcomes.

Analytical Thinking

The ability to systematically and logically break down complex problems or ideas into smaller, manageable parts to solve or understand them.

Research And Development

The research efforts a company undertakes to enhance current products and processes or to foster the creation of new products and processes.

Q7: Ulcer with necrosis of the muscle of

Q13: Patient admitted to observation following a highway

Q25: Primary hypertension.<br>ICD-10-CM Code:_

Q37: A domestic corporation is one whose assets

Q41: Daniel, who is single, estimates that the

Q43: Performance, Inc., a U.S. corporation, owns 100%

Q50: Loose body in the right ankle joint.<br>ICD-10-CM

Q97: The ACE adjustment can be positive or

Q116: Post-termination distributions that are charged against OAA

Q149: Nontax factors that affect the choice of