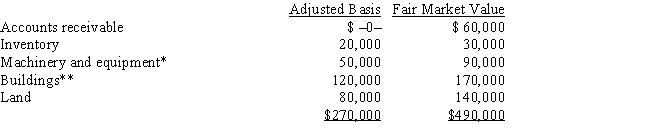

Albert's sole proprietorship owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Sketch

A rough or basic drawing that represents the main features or a general outline of a mathematical function or geometric figure.

\(C ( x )\)

A function notation often used to represent the cost associated with producing \(x\) items.

Graph

A visual representation of data or mathematical functions, typically drawn on a coordinate grid.

Domain

The set of all possible input values (usually x-values) for which a function is defined.

Q3: Codes for Chemotherapy drugs J9000-J9999 only include

Q11: Screening colonoscopy for colon cancer.<br>ICD-10-CM Code: _

Q19: IV<br>A)subcutaneous<br>B)intrathecal<br>C)inhalant<br>D)other routes<br>E)various routes<br>F)intramuscular<br>G)intravenous

Q23: Disguised sale<br>A)Organizational choice of many large accounting

Q49: Which of the following represents three of

Q67: Meg has an adjusted basis of $150,000

Q85: Compute Still Corporation's State Q taxable income

Q102: Discuss how a multistate business divides up

Q109: Martin, a single individual, has a

Q136: A distribution of cash or other property