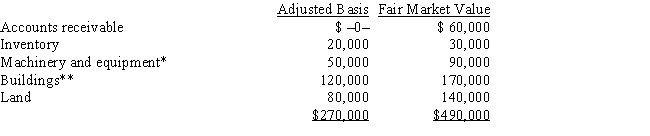

Mr. and Ms. Smith's partnership owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Self-Awareness

The understanding of one's personal identity, sentiments, driving forces, and aspirations.

Precontemplation And Contemplation

Stages in the Transtheoretical Model of Change indicating someone’s readiness for change; precontemplation is not considering change, contemplation is considering change but not yet ready to act.

Characteristics Of Clients

Refer to the distinguishing traits, features, or attributes that define individuals or groups receiving services from professionals such as social workers or counselors.

Stages Of Change

A model outlining the phases individuals typically go through when modifying behavior, from precontemplation to maintenance.

Q8: Established patient presents with chest pain.He has

Q19: Choledochoduodenal fistula.<br>ICD-10-CM Code:_

Q20: To the extent of built-in gain or

Q43: Cory is going to purchase the assets

Q50: Dyspnea.He gave a board rating of 5

Q53: An unlisted procedure code:<br>A)is a procedure or

Q66: According to the notes preceding the Category

Q87: Discuss two ways that an S election

Q109: An S corporation that has total assets

Q128: General partnership<br>A)Ability of all owners to have