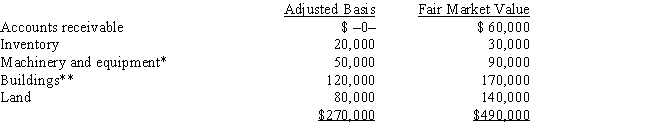

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

International Finance

The study of financial systems, currencies, and markets, and how they operate in the global context.

International Trade

The exchange of goods, services, and capital between countries, driven by comparative advantage and global demand.

Current Accounts Deficit

A measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the products it exports.

Current Account Deficit

An evaluation of a nation's trade balance when the cost of its imports surpasses the value of its exports in goods and services.

Q7: Doris is going to invest $90,000 in

Q7: An S shareholder's stock basis can be

Q8: A shareholder's basis in the stock of

Q12: There are two types of codes, but

Q22: The correct reporting for COPD with chronic

Q23: Disguised sale<br>A)Organizational choice of many large accounting

Q29: A modifier:<br>A)subtracts from the definition of the

Q46: USCo, a U.S. corporation, purchases inventory from

Q50: Dyspnea.He gave a board rating of 5

Q90: A limited partnership can indirectly avoid unlimited