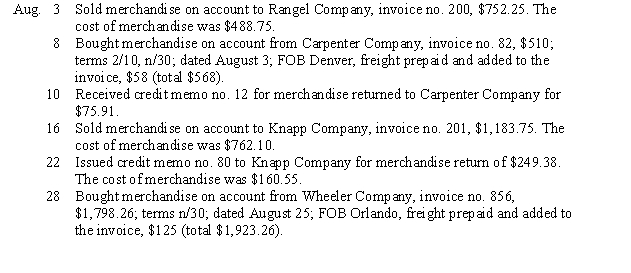

The following transactions relate to Hatfield Company, a furniture wholesaler, during August of this year. Terms of sale are 2/10, n/30. The company is located in Dallas, Texas.

Instructions:

Instructions:

Record the transactions in the general journal (page 1) using the perpetual inventory system.

Definitions:

Stand-Alone Basis

refers to evaluating an investment or project on its own merits without considering its interaction with other investments or projects.

Fixed Costs

Invariable expenditures that remain steady irrespective of the quantity of output or sales achieved, including tenancy charges, payroll, and insurance outlays.

Operating Cash Flow

The total money yielded from a company's standard business operations.

Net Income

The resulting earnings of a business after deducting all expenses and taxes from its total revenue.

Q2: When preparing the financial statements, Accumulated Depreciation

Q9: Title or ownership changes hands when the

Q13: Generally, the Accounts Receivable controlling account will

Q23: Miller Co. has a net loss for

Q42: Compare and contrast payroll Forms 940 and

Q52: The spaces in the purchases journal used

Q70: Tax form that represents the employer's annual

Q83: There is a ceiling on each employee's

Q97: The account used to record the reduction

Q104: Accounts whose balances apply to one fiscal