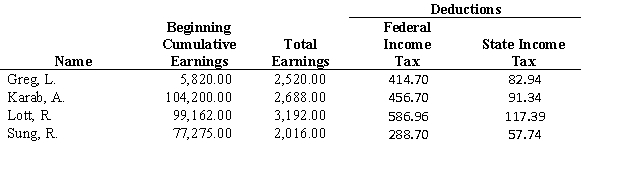

Ice Cold Storage has the following payroll information for the week ended November 20. State income tax is computed as 20 percent of federal income tax. Use page 77 for general journal.

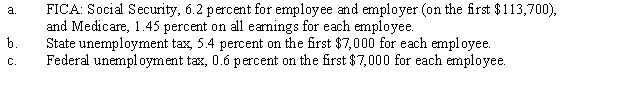

Assumed tax rates are as follows:

Assumed tax rates are as follows:

Instructions:

Instructions:

1.Complete the payroll register. Payroll checks begin with Ck. No. 6307 in the payroll register.

2.Prepare a general journal entry to record the payroll as of November 20. The company's general ledger contains a Salary Expense account and a Salaries Payable account.

3.Prepare a general journal entry to record the payroll taxes as of November 20.

4.Journalize the entry to pay the payroll on November 22. (Assume that the company has transferred cash to the Cash-Payroll Bank Account for this payroll.)

Definitions:

Cognitive Theorists

Researchers or psychologists who study the mental processes of perception, memory, judgment, and reasoning, and how these processes might influence behavior.

Social Anxiety Disorder

A chronic mental health condition characterized by significant anxiety or fear of social situations, where individuals feel overly concerned about being judged or embarrassed.

Negative Aspects

The unfavorable or harmful parts or characteristics of a situation, phenomenon, or substance.

GABA Systems

Refers to the system in the brain that uses gamma-aminobutyric acid (GABA) as a neurotransmitter, playing a key role in regulating nervous system activity and involved in anxiety disorders.

Q1: Which of the following would require a

Q6: Frank Delivery Services establishes a Change Fund

Q6: A fiscal period must begin on January

Q46: Generally, employers are required to withhold from

Q48: Number assigned to an account

Q50: How would the company's books be affected

Q63: Rank the steps of the accounting cycle

Q85: To examine in detail the weekly payroll

Q85: Place an X in the column that

Q89: Form 941 must be submitted quarterly.