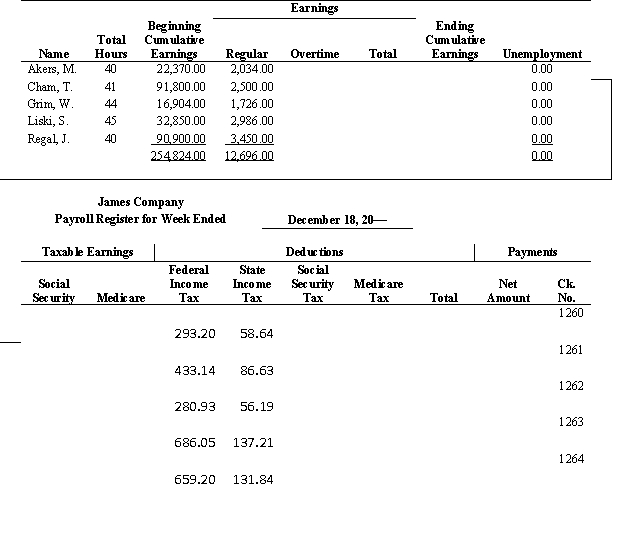

James Company has the following payroll information for the week ended December 18:

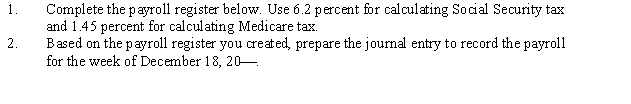

Taxable earnings for Social Security are based on the first $106,800. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week.

Taxable earnings for Social Security are based on the first $106,800. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week.

Instructions:

Definitions:

Misspelled

A term indicating that a word has been spelled incorrectly.

Correct Spelling

The process of ensuring that words are written according to the conventional rules of a language, often using tools like spell-checkers.

Slide Sorter

A feature in presentation software that displays thumbnails of slides, allowing users to organize and reorder their presentation easily.

Thumbnail

A small image representation of a larger image, used to make browsing and viewing multiple images easier.

Q16: On June 1 of this year, Estes

Q19: A _ is a record indicating the

Q33: The term, accrued wages, means that<br>A)expenses have

Q42: The Unearned Revenue account normally has a

Q47: J. Forest deposited $60,000 in the bank

Q48: The adjusting entry for unearned revenue involves

Q50: A cash payment of $130 on account

Q73: The portion of FICA taxes designated as

Q77: Posting an entire transaction twice will cause

Q102: An accounting system that records transactions using