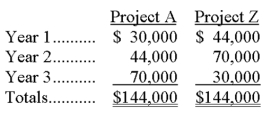

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

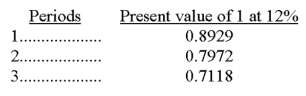

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Definitions:

Hypothesis

An educated guess formed on the grounds of restricted data, designed to facilitate more in-depth inquiry.

Dependent Variable

The variable in an experiment that is expected to change as a result of manipulations of the independent variable.

Fast-Food Consumption

The frequency at which individuals consume meals provided by fast-food restaurants.

Measurement

The process or the result of quantifying objects, phenomena, or relationships according to established rules and units.

Q7: Cost-volume-profit analysis can be used to predict

Q8: The master budget process usually ends with:<br>A)

Q25: Entrepreneurs can stimulate their own creativity and

Q36: The principle behind a _ strategy is

Q44: The balanced scorecard ideally looks at a

Q69: The following information comes from the records

Q89: Woods, Inc. budgeted the following overhead costs

Q126: Thomas Co. provides the following fixed budget

Q151: A limitation of the internal rate of

Q153: Cost-volume-profit analysis provides approximate, but not precise,