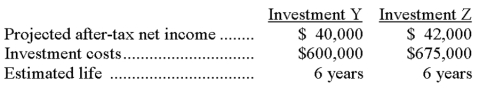

A company has a decision to make between two investment alternatives. The company requires a 10% return on investment. Predicted data is provided below:

The present value of an annuity for 6 years at 10% is 4.3553. This company uses straight-line depreciation.

Required:

(a) Calculate the net present value for each investment.

(b) Which investment should this company select? Explain.

Definitions:

Simple Interest

Interest assessed only on the base amount, or on whatever portion of the base amount has not been settled.

Interest

Payment made for the use of borrowed money, calculated as a percentage of the principal sum.

Simple Interest

Interest calculated only on the initial amount of money (principal), not on the interest accrued over time.

Investment

Allocation of resources, such as time, money, or effort, in hope of generating a future benefit or return.

Q14: The rapidly accelerating rate of change has

Q15: Operating budgets include all the following budgets

Q28: All of the following represent barriers to

Q86: A company has established 5 pounds of

Q89: If budgeted beginning inventory is $8,300, budgeted

Q97: The strategic planning process works best when

Q104: Which of the following is not an

Q107: There are three major subgroups of the

Q118: A company is planning to purchase a

Q164: The set of periodic budgets that are