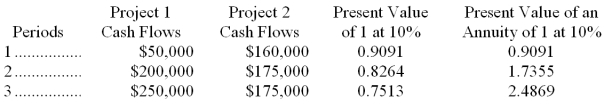

Braybar Company is deciding between two projects. Each project requires an initial investment of $350,000. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Braybar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Use net present value to determine which project should be pursued and explain why.

Definitions:

Income Elasticity

A measure used in economics to show how the demand for a good or service changes in response to changes in consumer income.

Elapses

Refers to the passage of time or the process of something coming to an end or expiring.

Inelastic Demand

Describes a situation where the demand for a good or service changes little when its price changes.

Total Revenue

The total amount of money generated from the sale of goods or services.

Q12: The primary cause of small business failure

Q18: When "brainstorming," individuals should be encouraged to

Q21: Gates Company collected the following data regarding

Q42: The lifeblood of the "brick and mortar"

Q46: Which of the following statements is not

Q49: Davison Company has fixed costs of $315,000

Q61: A company pursuing a cost-leadership strategy strives

Q91: _ is a graphical technique that encourages

Q112: A company is considering the purchase of

Q141: The difference between actual and standard cost