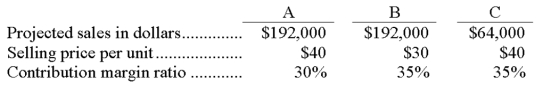

Joseph Co. has three products A, B, and C, and its fixed costs are $69,000. The sales mix for its products are 3 units of A, 4 units of B, and 1 unit of C. Information about the three products follows:

(a) Calculate the company's break-even point in composite units and sales dollars.

(b) Calculate the number of units of each individual product to be sold at the break-even point.

Definitions:

Expiration Date

The date on which an option, futures contract, or other derivative expires and becomes void.

MBI Stock

This term does not seem to reference a commonly recognized financial instrument or concept; it might refer to the stock of a specific company identified by the acronym MBI, but without further context, a detailed definition cannot be provided.

Futures Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price on or before a certain date.

Futures Contract

A contractual arrangement to purchase or sell a specific asset or commodity at an agreed price on a future date.

Q46: Kyoto, Inc. predicts the following sales in

Q60: Explain how a service firm, such as

Q67: The ratio of the volumes of the

Q78: The difference between a profit center and

Q83: Job order production systems would be appropriate

Q93: An activity _ is a temporary account

Q113: Embark produces mulch for landscaping use. The

Q136: Within an organizational structure, the person most

Q138: For an investment center, the hurdle rate

Q163: A job cost sheet shows information about