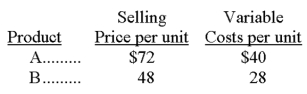

A firm sells two different products, A andA. Total fixed costs for this firm are $1,260,000. Additional selling prices and cost information for both products follow:

Required: (a) Calculate the contribution margin per composite unit.

(b) Calculate the break-even point in units of each individual product.

(c) If pretax income before taxes of $294,000 is desired, how many units of A and B must be sold?

B. For each unit of B, the firm sells two units of

B. For each unit of B, the firm sells two units of

Definitions:

Egoistic Suicide

Occurs when the person is inadequately integrated into society.

Anomic

A state or condition of individuals or society characterized by a breakdown or absence of social norms and values, often leading to alienation and disorientation.

Adolescent Suicide

The act of self-inflicted death by individuals in their teenage years, often resulting from a variety of psychological, social, and environmental pressures or disorders.

Contemporary Times

The current or most recent period, characterized by modern or present-day conditions, technology, and society.

Q19: Curvilinear costs always increase:<br>A) With decreases in

Q43: Variable costs per unit increase proportionately with

Q65: An analytical technique used by management to

Q86: A measure used to evaluate the manager

Q108: During March, the production department of a

Q118: When preparing the cash budget, all the

Q119: Equivalent units of production need to be

Q127: Curvilinear costs are also known as nonlinear

Q156: The number of equivalent units of production

Q156: The relevant range of operations includes extremely