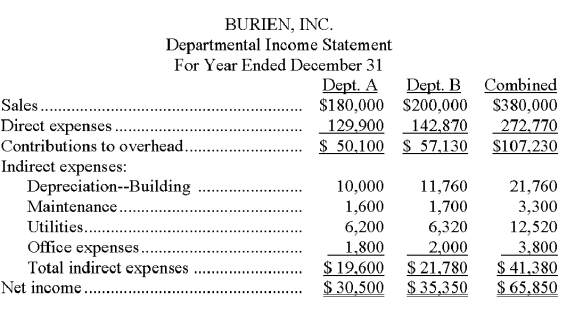

Burien, Inc., operates a retail store with two departments, A and

B. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

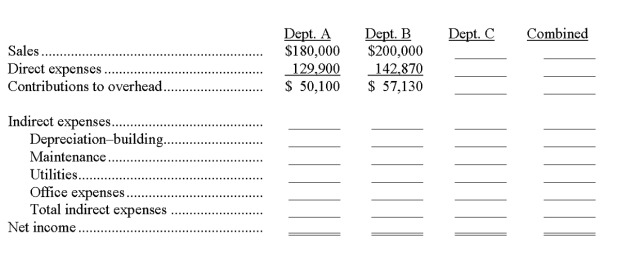

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Definitions:

Labor Productivity

Labor productivity measures the output of goods and services produced by labor per unit of time, often assessed to evaluate the efficiency of a workforce.

Velocity of Money

The rate at which money is exchanged from one transaction to another and how much a unit of currency is used in a given period of time.

Classical Assumption

In economics, refers to the traditional ideas that free markets function under equilibrium with full employment and price flexibility.

Money Balances

The total amount of money held by an individual or entity at any given time.

Q7: Equivalent units of production are equal to:<br>A)

Q13: Define variable cost, fixed cost, and mixed

Q18: In a process cost accounting system, the

Q36: Yoho Company reported the following financial numbers

Q62: A product is sold for $45 and

Q64: The Lamb Company budgeted sales for January,

Q67: The financial budgets include the cash budget

Q108: Which of the following is never included

Q113: Cambridge, Inc., is preparing its master budget

Q133: Eleanor Reed, the manager of the Marinette