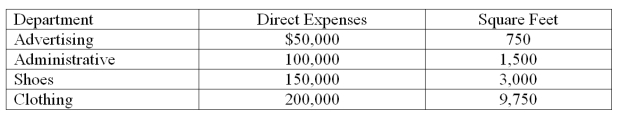

Naples operates a retail store and has two service departments and two operating departments, Shoes and Clothing. During the current year, the departments had the following direct expenses and occupied the flowing amount of floor space.

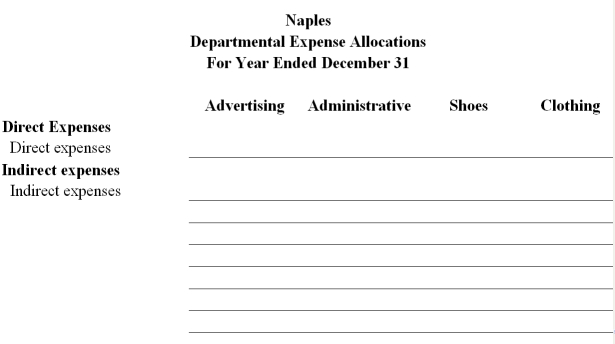

The advertising department developed and aired 150 spots. Of these spots, 60 spots were for Shoes and 90 spots were for Clothing. The store sold $1,500,000 of merchandise during the year; $675,000 in Shoes and $825,000 in Clothing. Indirect expenses include rent, utilities, and insurance expense. Total indirect expenses of $220,000 are allocated to all departments. Prepare a departmental expense allocation spreadsheet for Naples. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) allocate the indirect expenses to each department on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of ad spots placed promoting each department's products, (4) the administrative department's expenses based on the amount of sales. Complete the departmental expense allocation spreadsheet below. Provide supporting computations for the expense allocations below the spreadsheet.

Definitions:

Robert Mugabe

A Zimbabwean revolutionary and politician who served as Prime Minister from 1980 to 1987 and then as President from 1987 to 2017.

Henry Ford

An American industrialist and founder of the Ford Motor Company, who revolutionized factory production with his assembly-line methods.

Max Ringelmann

A French agricultural engineer who discovered the Ringelmann effect, noting that individual productivity decreases as the size of a group increases.

Highly Assertive

Characterized by confident and forceful behavior or attitudes, especially in stating one's opinions or claiming one's rights.

Q6: Financial budgets include all the following except

Q19: Curvilinear costs always increase:<br>A) With decreases in

Q34: Direct costs in process cost accounting include

Q44: Which of the following is not a

Q66: Using the information below for Hardy Company;

Q97: A product has a contribution margin per

Q143: Penn Company uses a job order cost

Q153: BC Company uses a job order cost

Q157: Bristol Company's contribution margin income statement is

Q178: Hess Co. manufactures a product that sells