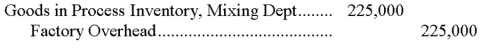

If the predetermined overhead allocation rate is 225% of direct labor cost, and the Mixing Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

Definitions:

Stock Split

A corporate action that increases the number of a company's shares by issuing more shares to current shareholders, thus reducing the price per share.

Common Stock Dividend

A portion of a company's earnings distributed to shareholders of its common stock, typically in the form of cash or additional shares.

Common Shares Outstanding

The total number of shares of a company that are owned by shareholders, excluding shares owned by the company itself.

Treasury Stock

Shares previously counted among a company's outstanding shares but were later bought back by the business.

Q3: Both financial and managerial accounting report monetary

Q24: A process cost summary shows the cost

Q64: A company that uses a job order

Q76: Dividing a mixed cost into its separate

Q80: A _ cost is one that includes

Q101: For a manufacturing firm, cycle time may

Q102: Factory overhead is often collected and summarized

Q134: A system of accounting in which the

Q150: In some circumstances, a process cost accounting

Q162: A _ system means that a company