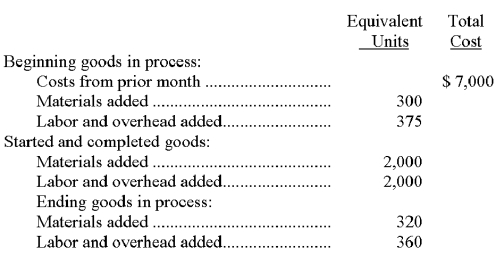

Refer to the following information about the Dipping Department of the Indiana Factory for the month of August. Indiana Factory uses the FIFO method of inventory costing.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned to the ending goods in process inventory for August.

Definitions:

Disposable Income

Post-tax income households possess for saving or spending purposes.

Disposable Income

Disposable income refers to the sum of money that families can use for expenditures and savings once income taxes are deducted.

MPS (Marginal Propensity to Save)

The proportion of an increase in income that an individual or population saves rather than spends on consumption.

APC (Average Propensity to Consume)

The fraction of income that households plan to spend on goods and services; it is the ratio of total consumption to total disposable income.

Q7: Cost-volume-profit analysis can be used to predict

Q16: Management anticipates fixed costs of $72,500 and

Q34: The R&R Company's production costs for August

Q34: A factor that causes the cost of

Q44: Direct costs are incurred for the benefit

Q73: A _ cost contains a combination of

Q73: Selected information from the budget of the

Q112: An out-of-pocket cost requires a future cash

Q142: Describe what happens to the net income

Q158: Data pertaining to a company's joint production