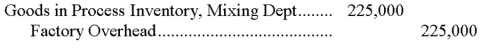

If the predetermined overhead allocation rate is 225% of direct labor cost, and the Mixing Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

Definitions:

Insolvent

The condition of being unable to pay off owed debts as they become due.

Total Outstanding Stock

The total shares of a company's stock that are currently owned by all its shareholders, including shares held by institutional investors and restricted shares.

Corporate Form

A legal structure for businesses recognized by law as a separate legal entity with rights, privileges, and liabilities distinct from those of its owners.

Limited Liability

A legal principle that protects a company's shareholders from being personally responsible for the company's debts, limiting their losses to the amount invested.

Q36: Brown Company's contribution margin ratio is 24%.

Q52: A materials consumption report is a source

Q60: What is the purpose of a responsibility

Q86: A measure used to evaluate the manager

Q87: The difference between the unit sales price

Q115: What is activity-based budgeting?

Q126: A company uses the FIFO method for

Q134: O.K. Company uses a job order cost

Q145: A company that applies process costing is

Q150: Bard Manufacturing uses a job order cost