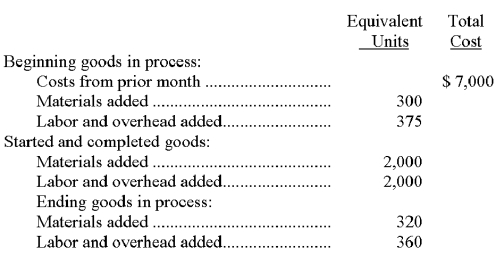

Refer to the following information about the Dipping Department of the Indiana Factory for the month of August. Indiana Factory uses the FIFO method of inventory costing.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned to the ending goods in process inventory for August.

Definitions:

End-Of-Period Accrual

Accounting adjustments made at the end of accounting periods to record revenues earned and expenses incurred but not yet recorded.

Sales Returns

Transactions where customers return previously purchased merchandise, leading to the reversal of revenue and reduction in sales figures.

Gross Accounts Receivable

The total amount owed to a company by its customers before deducting any allowance for doubtful accounts.

Accrual Accounting

A financial recording approach in which earnings and expenditures are documented upon being accrued, without considering the timing of the associated cash movements.

Q10: Ajax Company accumulated the following account information

Q11: A trend percent, or index number, is

Q18: A department can never be considered to

Q28: When factory payroll is assigned to specific

Q39: A _ accounting system records production activities

Q69: Mach Co. operates three production departments as

Q75: If Department G uses $53,000 of direct

Q100: During March, the production department of a

Q101: A job order cost accounting system would

Q164: Laurel and Hardy are managers of two