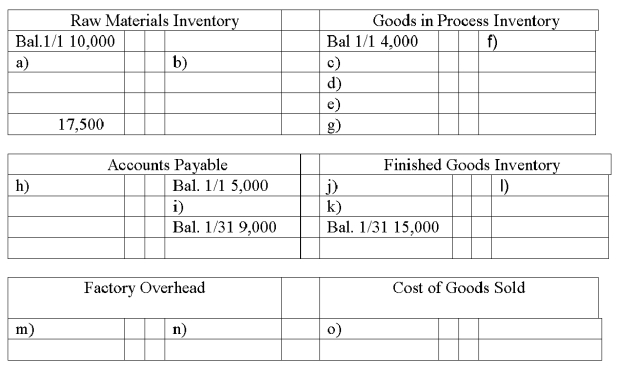

Medlar Corp. maintains a Web-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Definitions:

Capillary Refill

A quick test to assess blood circulation where pressure is applied to a nail or skin to see how fast color returns, indicating capillary efficiency.

Immediate Memory

The capacity to hold a small amount of information in mind in an active, readily available state for a short period.

Adduction

The movement of a body part toward the central axis of the body.

Abduction

The movement of a limb or body part away from the midline of the body or away from another body part.

Q18: In a process cost accounting system, the

Q70: What are prime costs? What are conversion

Q79: How do companies decide what allocation bases

Q105: The building blocks of financial statement analysis

Q108: If it is a material amount, overapplied

Q126: The file of job cost sheets for

Q149: Expenses that are not easily associated with

Q168: The first step in accounting for production

Q182: Graphical analysis of the balance sheet can

Q197: Which of the following costs would not