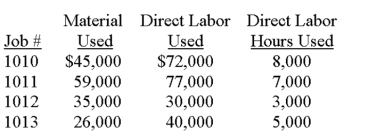

Dina Corp. uses a job order cost accounting system. Four jobs were started during the current year. The following is a record of the costs incurred:

Actual overhead costs were $55,800. The predetermined overhead allocation rate is $2.40 per direct labor hour. During the year, Jobs 1010, 1012, and 1013 were completed. Also, Jobs 1010 and 1013 were sold for $387,000. Assuming that this is Dina's first year of operations:

(a) Make the necessary journal entries to charge the costs to the jobs started and to record the completion and sale of finished jobs.

(b) Calculate the balance in the Goods in Process Inventory, Finished Goods Inventory, and Factory Overhead accounts. Does the Factory Overhead account balance indicate an over- or under applied overhead?

Definitions:

Tenant-Days

A metric used in the hospitality and rental industry to quantify the total number of days that tenants occupy a space over a certain period.

Planning Budget

A planning budget is an outline of the expected revenues and expenses over a particular period, serving as a roadmap for financial management and operational goals.

Budgeting Formulas

Mathematical expressions or equations used to calculate, allocate, and manage financial resources over a specific period.

Direct Materials

Materials that become an integral part of a finished product and whose costs can be conveniently traced to it.

Q20: General-purpose financial statements include the (1) staement

Q21: The potential benefit lost by taking a

Q53: Using the information below for Talking Toys,

Q68: If Department A uses $10,000 of direct

Q102: Raw materials purchased plus beginning raw materials

Q121: The standards for comparisons in financial statement

Q162: The background on a company, its industry,

Q171: A manufacturing company has a beginning finished

Q184: Four factors come together in the manufacturing

Q195: Information for Reedy Manufacturing is presented below.