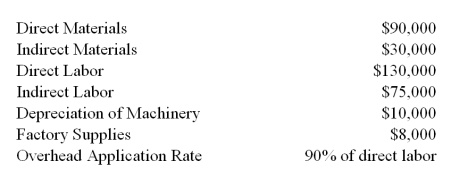

Marshall Corp. uses a job order cost accounting system and worked only on Job 101 during the current period. Job 101 was sold for $460,000. The following information pertains to costs incurred for Job 101.

Definitions:

Partnership Tax Return

A partnership tax return is a document filed with the IRS that reports the income, deductions, and losses of a partnership, which are then passed through to the partners to report on their individual returns.

Q37: An opportunity cost is:<br>A) An uncontrollable cost.<br>B)

Q45: Express the following balance sheets for Alberts

Q82: A company's calendar-year financial data are shown

Q94: Factory overhead includes selling and administrative expenses

Q108: If it is a material amount, overapplied

Q117: The managers of process manufacturing systems focus

Q118: Standards for comparison when interpreting financial statement

Q119: Allocations of joint product costs can be

Q127: What is the purpose of a departmental

Q130: Explain the purpose of financial statement analysis