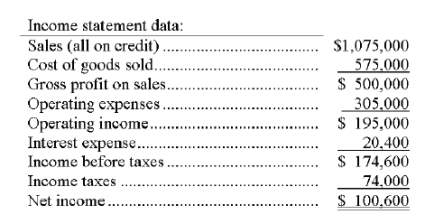

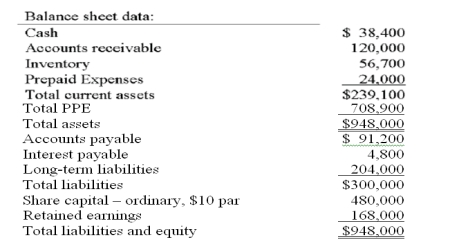

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days' sales uncollected.

(d) Inventory turnover. (Assume the prior year's inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on ordinary shareholders'equity. (Assume the prior year's share capital on ordinary shares balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only ordinary shares outstanding).

(h) Price earnings ratio. (Assume the company's shares are selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)

Definitions:

Flashbulb Memories

Vivid, detailed memories of significant or emotional events, which feel as if they have been captured like a photograph.

September 11

A date marked by terrorist attacks in 2001 on the United States, specifically targeting the World Trade Center in New York City and the Pentagon.

World Trade Center

A large complex of office buildings in Lower Manhattan, New York, known for being the site of a terrorist attack on September 11, 2001.

Repression

Repression is a psychological defense mechanism where unpleasant thoughts, feelings, or desires are unconsciously excluded from consciousness.

Q5: When an investor company owns more than

Q30: The Terrapin Manufacturing Company has the following

Q31: Costs that are incurred as part of

Q35: On June 18, Johnson Company (a U.S.

Q52: Trend percentage is calculated by dividing _

Q62: Describe the use of the Factory Payroll

Q85: A manufacturing company's finished goods inventory on

Q87: Sanuk purchased on credit <font face="symbol"></font>20,000 worth

Q123: Match each of the following terms with

Q157: Investing activities include: (a) the purchase and