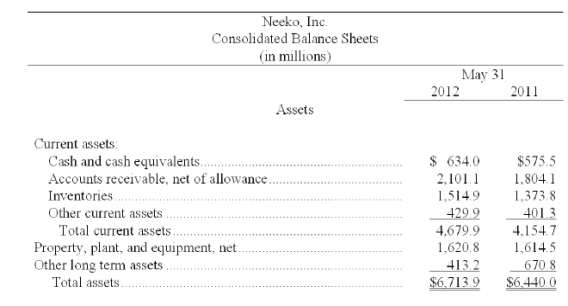

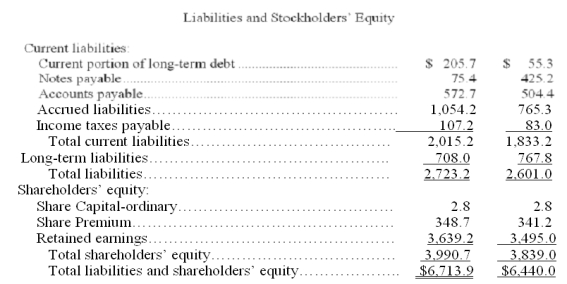

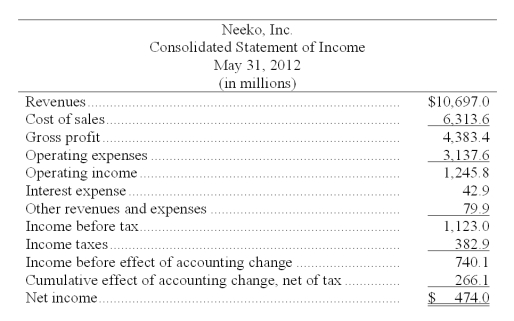

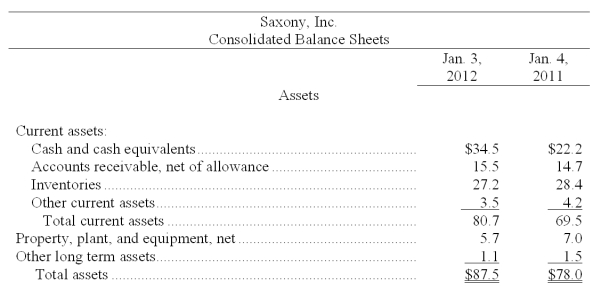

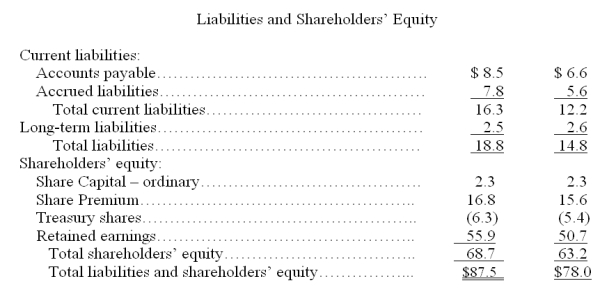

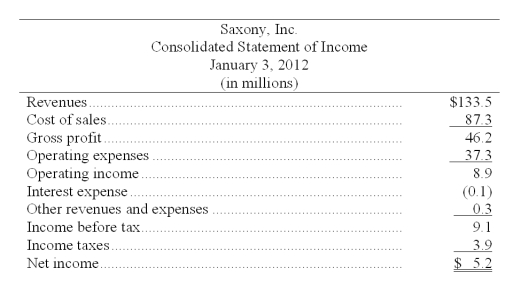

The following summaries from the income statements and balance sheets of Neeko, Inc. and Saxony, Inc. are presented below.

(1) For both companies for 2012, compute the

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies for 2012, compute the

(a) Profit margin ratio

(b) Return on total assets

(c) Return on ordinary shareholders'equity

Which company do you consider to have better profitability ratios?

Definitions:

Scripts Interview Questions

Preset questions based on typical scripts or scenarios used in interviews to assess how individuals might respond in specific situations.

Personnel Psychologist

A professional who applies psychological principles and techniques to workplace issues, including talent acquisition, evaluation, training, and development.

Graphic Rating Scales

A method of evaluation that uses a visual scale marked with points along a continuum to measure attitudes, feelings, or levels of performance.

Behavior Rating Scales

Tools used to assess the behaviors, personality, and competencies of individuals through standardized ratings.

Q15: Investments in held-for-trading securities are always classified

Q39: Cost concepts such as variable, fixed, mixed,

Q82: An example of a transaction that must

Q86: Key Manufacturing Co. applies factory overhead to

Q105: Sinking fund bonds:<br>A) Require the issuer to

Q128: The cash flow on total assets ratio

Q135: Products that have been completed and are

Q158: Whether a cost is controllable or not

Q170: Cash paid for merchandise is an operating

Q178: For each of the characteristics below, identify