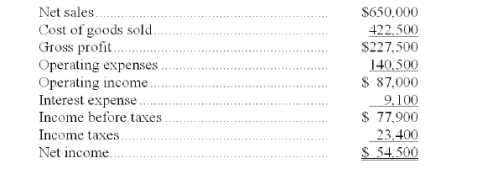

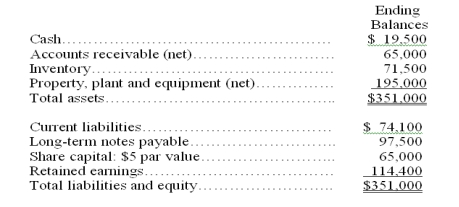

A company's calendar-year financial data are shown below. The company had total assets of $339,000 and total equity of $144,400 for the prior year. No additional shares were issued during the year. The December 31 market price per share is $49.50. Cash dividends of $19,500 were paid during the year. Calculate the following ratios for the company:

(a) profit margin ratio.

(b) gross margin ratio.

(c) return on total assets.

(d) return on ordinary shareholders'equity.

(e) basic earnings per share.

(f) price earnings ratio.

(g) dividend yield.

Definitions:

Q1: On January 1, $300,000 of par value

Q9: The focus of managerial accounting is on

Q19: When using the equity method for investments

Q46: An investing company that owns more than

Q73: A company may retire bonds by:<br>A) Exercising

Q73: _ are equity securities that a company

Q109: Describe the journal entries required to record

Q110: The cost of all materials issued to

Q133: Define and explain significant noncash investing and

Q147: What are the five usual steps involved