Essay

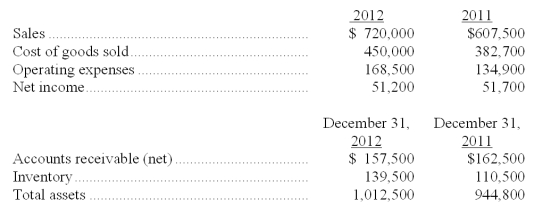

Comparative calendar-year financial data for a company are shown below. Calculate the following ratios for the company for 2012:

(a) accounts receivable turnover

(b) day's sales uncollected

(c) inventory turnover

(d) days' sales in inventory

Definitions:

Related Questions

Q21: The return on total assets ratio is

Q25: Use the financial data shown below to

Q59: Beewell's net income for the year ended

Q63: A company borrowed $50,000 cash from the

Q77: In comparison to a general accounting system

Q93: Explain how cash flows from investing and

Q134: Match the following terms with the appropriate

Q144: On January 1, a company issues bonds

Q153: BC Company uses a job order cost

Q157: Investing activities include: (a) the purchase and