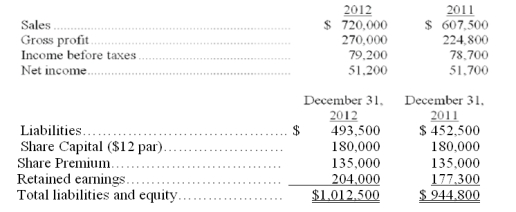

Comparative calendar year financial data for a company are shown below. Calculate the following ratios for 2012:

(a) return on total assets.

(b) return on ordinary shareholders' equity.

Definitions:

Exercise Price

The rate at which a call option allows buying or a put option allows selling of the underlying financial instrument or commodity.

Put Option

A contractual agreement allowing the possessor the choice, not the duty, to dispose of a particular volume of an underlying asset at an agreed-upon rate before a certain deadline.

Strike Price

The predetermined price at which an option's holder has the right to purchase (for a call option) or sell (for a put option) the underlying asset.

Q10: Explain the difference between short-term and long-term

Q24: Use the following calendar-year information to prepare

Q28: When factory payroll is assigned to specific

Q54: Overapplied or underapplied overhead should be removed

Q87: Information for Gifford, Inc., as of December

Q121: Juliet Corporation has accumulated the following accounting

Q127: Adidas issued 10-year, 8% bonds with a

Q142: Bonds and long-term notes are similar in

Q143: A company's total liabilities divided by its

Q182: The following information relates to the manufacturing