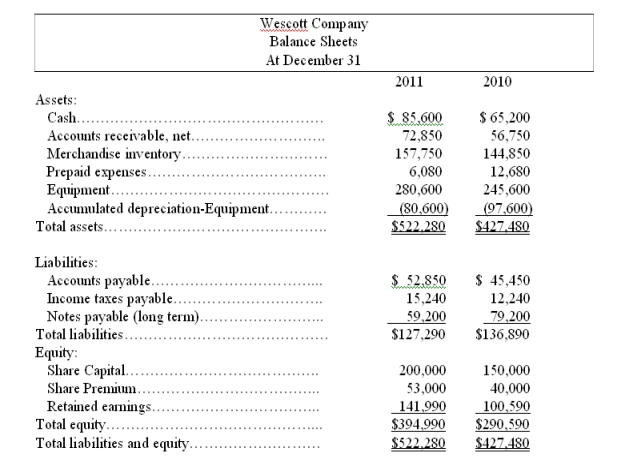

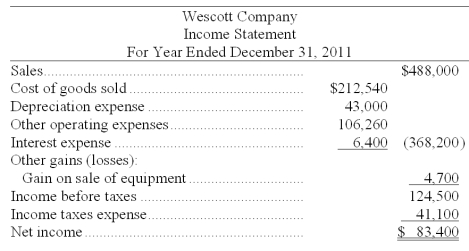

Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 2011 using the indirect method, and (2) compute the company's cash flow on total assets ratio for 2011.

Additional Information

Additional Information

a. A $20,000 note payable is retired at its carrying amount in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid. Cash dividends paid is to be classified under financing activities.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Definitions:

Central Planning Board

A government body responsible for determining the allocation of resources and directing economic activity in a centrally planned economy.

Pure Capitalist Economy

An economic system where private individuals and firms control all resources, and market forces determine resource allocation with minimal government intervention.

Price Mechanism

The system by which the forces of supply and demand determine the prices of goods and services and allocate resources within an economy.

John Kenneth Galbraith

John Kenneth Galbraith was an influential Canadian-American economist and public intellectual who contributed significantly to the development of modern economic thought, particularly in the areas of consumer behavior, public policy, and economic history.

Q36: Seamark buys $300,000 of Eider's 8% five-year

Q45: Investments in held-for-trading securities are accounted for

Q49: Explain the present value concept as it

Q52: Trend percentage is calculated by dividing _

Q59: A company has $424,000 in total shareholders'

Q60: Which of the following statements is correct

Q89: The controlling investor is called the:<br>A) Owner.<br>B)

Q102: If a company resells treasury shares below

Q103: A company issued 10-year, 9% bonds, with

Q123: Explain how equity securities having significant influence