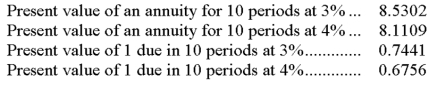

On January 1, a company issues bonds with a par value of $300,000. The bonds mature in 5 years and pay 8% annual interest each June 30 and December 31. On the issue date, the market rate of interest is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Definitions:

Accumulated Comprehensive Income

The total of all net income and other comprehensive income items that have been accumulated over the life of a company.

Net Income

The total profit or loss a company generates from its operations, after subtracting all expenses, taxes, and costs.

Balance Sheet

A financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a basis for computing rates of return and evaluating its capital structure.

Total Assets

The sum of all assets owned by an entity, including both current and non-current assets, representing the total resources available for use in operations.

Q11: Sam, Bart, and Lex are dissolving their

Q32: The rate of interest that borrowers are

Q56: are corrections of material errors in prior

Q56: The present value of an annuity factor

Q78: The withdrawals account of each partner is:<br>A)

Q93: B. Tanner contributed $14,000 in cash plus

Q94: Rhone Importers purchases automotive parts from Germany.

Q107: A company is authorized to issue 50,000

Q141: On January 1, a company borrowed $70,000

Q170: is/are responsible for and have final authority