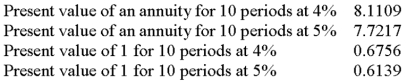

On January 1, a company issues bonds with a par value of $300,000. The bonds mature in 5 years, and pay 8% annual interest, payable each June 30 and December 31. On the issue date, the market rate of interest for the bonds is 10%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Definitions:

Corporation Income Taxes

Taxes applied to the income or profit of corporations.

Small Corporations

These are businesses that are smaller in size, often categorized by fewer employees or lower annual revenue.

Income

The flow of cash or its equivalent received from work or investments over time.

Investment

The allocation of resources, usually financial, to assets or projects expected to generate future profits or benefits.

Q8: An _ is a series of equal

Q17: A company reports the following shareholders' equity:<br>

Q24: Use the following calendar-year information to prepare

Q33: Define the cash flow on total assets

Q39: An advantage of bond financing is that

Q87: A company issues bonds with a par

Q106: In preparing a company's statement of cash

Q132: A partnership recorded the following journal entry:

Q143: Match each of the following terms with

Q144: Foreign exchange rates fluctuate due to many