A company purchased two new delivery vans for a total of $250,000 on January 1, Year 1. The company paid $40,000 cash and signed a $210,000, 3-year, 8% note for the remaining balance. The note is to be paid in three annual end-of-year payments of $81,487 each, with the first payment on December 31, Year 1. Each payment includes interest on the unpaid balance plus principal.

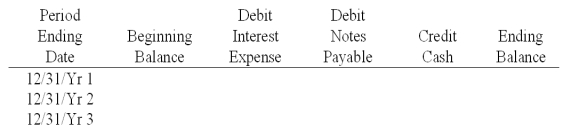

(1) Prepare a note amortization table using the format below:

(2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

Definitions:

Information Content Effect

Refers to how a company's stock price reacts to the announcement of financial information, indicating the market's response based on the news' perceived value.

Dividend Payout

Dividend Payout refers to the proportion of earnings that a company distributes to its shareholders as dividends.

NPV Projects

Projects evaluated using Net Present Value, a method to calculate the profitability by comparing the present value of cash inflows with the present value of cash outflows over time.

Low Dividend Payouts

A company strategy of distributing relatively small portions of earnings to shareholders as dividends.

Q32: The rate of interest that borrowers are

Q48: The use of debt financing insures an

Q53: When a partner is added to a

Q61: A contingent liability:<br>A) Is always of a

Q84: The _ ratio is used to assess

Q85: _ activities generally include those transactions and

Q140: A bond sells at a discount when

Q141: Typical cash flows from investing activities include:<br>A)

Q156: Probably the most important section of the

Q175: A special bank account used solely for