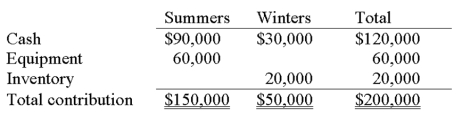

Summers and Winters formed a partnership on January 1. Summers contributed $90,000 cash and equipment with a market value of $60,000. Winters' investment consisted of: cash, $30,000; inventory, $20,000; all at market values. Partnership net income for year 1 and year 2 was $75,000 and $120,000, respectively.

1. Determine each partner's share of the net income for each year, assuming each of the following independent situations:

(a) Income is divided based on the partners' failure to sign an agreement.

(b) Income is divided based on a 2:1 ratio (Summers: Winters).

(c) Income is divided based on the ratio of the partners' original capital investments.

(d) Income is divided based on interest allowance of 12% on the original capital investments; salary allowance to Summers of $30,000 and Winters of $25,000; and the remainder to be divided equally.

2. Prepare the journal entry to record the allocation of the Year 1 income under alternative (d) above.

Part 1: Calculation of partners' capital contributions:

Definitions:

The Genotype

Refers to the genetic composition of an organism, including all its genes, contributing to its unique phenotype.

Nature

The inherent features of something or the physical world and everything in it, including plants, animals, the landscape, and other features and products of the earth.

Nurture

The influence of environmental factors and care given to the development and growth of an individual.

Behavioral Genetics

The field of study that examines the role of genetic and environmental influences on behaviors.

Q1: On January 1, $300,000 of par value

Q10: During August, Arena Company sells $356,000 in

Q10: Retained earnings:<br>A) Generally consists of a company's

Q62: A bank that is authorized to accept

Q76: A company had net income of $76,000

Q100: Par value per share is the price

Q130: A company had a beginning balance in

Q136: A bondholder that owns a $1,000, 10%,

Q137: Mortgage bonds are backed only by the

Q162: A company made an error in calculating