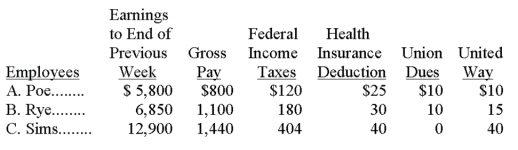

The payroll records of a company provided the following data for the current weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Permanent

Describing something that is intended to exist or function for an indefinite duration without significant change.

Unalterable

Incapable of being changed or modified.

Media

Channels or systems of communication that distribute information and entertainment to a wide audience.

Real World

The sphere of everyday life and experiences outside of fictional, virtual, or theoretical environments.

Q15: There is a credit balance in Share

Q40: Unearned revenues are amounts received _ for

Q47: A total asset turnover ratio of 3.5

Q47: The wage bracket withholding table is used

Q63: Decision makers and other users of financial

Q78: The withdrawals account of each partner is:<br>A)

Q104: _ refers to the expected proceeds from

Q134: Partner return on equity is calculated as

Q145: On January 1, Year 1, Acadia purchased

Q168: The following information is taken from Hogan