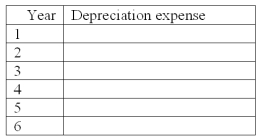

The Weiss Company purchased a truck for $95,000 on January 2. The truck was estimated to have a $3,000 residual value and a 4 year life. The truck was depreciated using the straight-line method. During the third year, it was obvious that the truck's total useful life would be 6 years rather than 4, and the residual value at the end of the 6th year would be $1,500. Determine the depreciation expense for the truck for the 6 years of its life.

Definitions:

Strong Arm Collection Agency

A debt collection agency known for using aggressive and often intimidating tactics to recover owed money.

Itinerant Sellers

Sellers who do not have a fixed place of business and travel from place to place to sell their goods or services.

Repudiated

Referring to the rejection or denial of a claim, agreement, or duty typically in a legal context.

Offer Accepted

The confirmation by one party to agree to the terms of an offer made by another party, leading to a contract.

Q3: A bank reconciliation explains any differences between

Q4: Depreciation is higher and income is lower

Q55: The matching principle requires that accrued interest

Q74: A company has the following unadjusted account

Q80: All of the following statements regarding long-term

Q91: A dishonored note receivable is usually reclassified

Q118: A partnership in which all partners have

Q123: Under the net method an invoice for

Q142: Accounting information systems collect and process data

Q182: What is the purpose of the days'