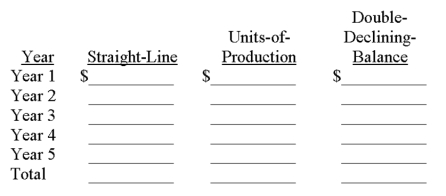

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a residual value of $75,000). During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Original Cost

The initial purchase price or construction cost of an asset before adjustments for depreciation or amortization.

Trading Securities

Financial instruments, such as stocks or bonds, that are bought and held primarily for the purpose of selling them in the near term to profit from price fluctuations.

Income Statement

A financial statement that shows a company's revenues, expenses, and profits over a certain period.

Valuation Allowance Accounts

Accounts used to adjust the carrying value of deferred tax assets to the amount that is more likely than not to be realized.

Q8: Amounts received in advance from customers for

Q19: A company purchased land with a building

Q32: The general journal is used for transactions

Q78: The withdrawals account of each partner is:<br>A)

Q88: Myrex Corporation purchased $4,000 in merchandise from

Q94: Dividend payment involves three important dates. They

Q104: On September 30 of the current year,

Q105: Assets invested by a partner into a

Q169: On April 1, Year 5 a company

Q178: Sales taxes payable is credited and cash