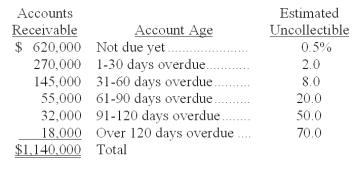

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Flash Memory Devices

Nonvolatile electronic storage devices that are compact, are portable, require little power, and contain no moving parts.

Nonvolatile

Referring to a type of computer memory that retains its data even when the power is switched off.

Electronic Storage

Refers to the storing of data on electronic media, typically involving devices such as hard drives, SSDs, memory cards, or cloud storage services.

Fastest Computers

Supercomputers that lead in computational speed and performance, often measured by their ability to perform floating-point operations per second (FLOPS).

Q18: Blake Company pays its employees for two

Q41: _ are short-term, highly liquid investment assets

Q60: _ is the charge for using (not

Q98: The Petty Cash account is a separate

Q103: Louise Company reported the following income statement

Q112: When posting from special journals each debit

Q132: A set of procedures and approvals designed

Q143: Intangible assets include:<br>A) Patents.<br>B) Copyrights.<br>C) Trademarks.<br>D) Goodwill.<br>E)

Q153: A _ is a report explaining any

Q195: A company purchased a delivery van for