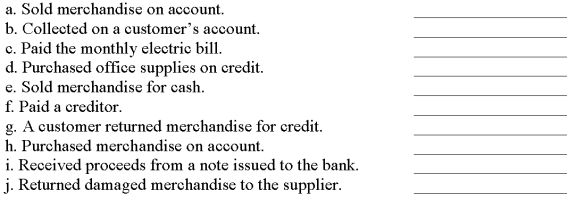

A company records its transactions and events in four special journals and a general journal. The company completed the following transactions a through j. Identify the journal in which each transaction should be recorded.

Definitions:

Total Assets

The sum of all owned resources that have economic value and can be converted into cash, which appear on a company's balance sheet.

Accrued Expenses

Expenses that have been incurred but not yet paid, recognized in the financial statements before the cash transactions occur.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Accrue Wages Expense

The recognition of wages incurred by employees that have not yet been paid by the company.

Q14: Individual transactions in the sales journal are

Q18: Fast Auto Parts is an auto parts

Q40: Harriet's Toy Shop had net sales of

Q63: A company purchased $11,200 of merchandise on

Q75: The current ratio is computed by dividing

Q113: After adjustment, the balance in the Allowance

Q115: A company reported the following information for

Q120: Brig Company had $800,000 in sales, sales

Q126: A company had net sales of $500,000

Q140: The person who signs a note receivable