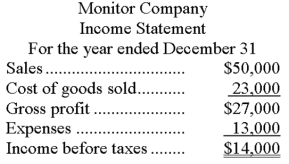

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Definitions:

Eugene Kinckle Jones

An influential African American leader and one of the founding members of the National Urban League, devoted to improving socio-economic conditions for African Americans in the early 20th century.

Boll Weevil

A beetle that feeds on cotton buds and flowers, historically causing massive damage to the cotton industry.

Immigration

The action of coming to live permanently in a foreign country, often for work, family reunion, or as a refuge from conflict or persecution.

Dust Bowl

A period of severe dust storms during the 1930s, causing significant ecological and agricultural damage to American and Canadian prairies.

Q27: On a work sheet, the adjusted balances

Q31: Which of the following statements is incorrect?<br>A)

Q32: Generally accepted accounting principles require that the

Q33: The following information is available for Trico

Q67: Separation of duties divides responsibility for a

Q74: The _ method of assigning costs to

Q88: A company uses four special journals: purchases,

Q125: Some companies choose to avoid assigning incidental

Q141: The summary amounts below appear in the

Q165: When LIFO is used with the periodic