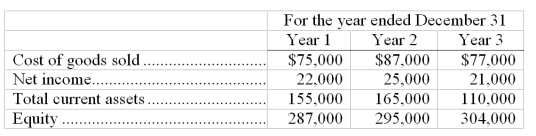

The City Store reported the following amounts on their financial statements for Year 1, Year 2, and Year 3:

It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

Definitions:

Anticipatory Breach

Occurs when one party to a contract indicates, before the performance is due, that they will not fulfill their contractual obligations.

Misrepresentation

An untrue statement of fact; an incorrect or false representation.

Deposit

A sum of money placed in an account or given as security for the fulfillment of a contractual obligation.

Exculpatory Clauses

Provisions in a contract that release one party from liability for harm caused, typically found in waiver and release agreements.

Q26: One of the most important decisions in

Q30: Adjusting entries made at the end of

Q31: Which of the following statements is incorrect?<br>A)

Q42: A company made the following purchases during

Q99: A log that is used to record

Q106: Subsidiary ledgers do all of the following

Q135: The main difference in the sales journal

Q140: When a company uses special journals, the

Q167: Cost of goods sold is also called

Q187: On July 24 of the current year,