Classified balance sheets commonly include the following categories.

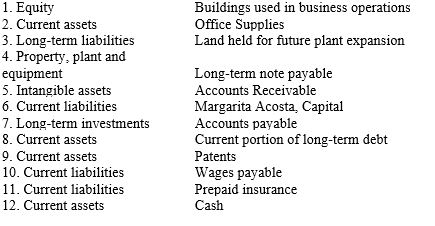

Indicate the typical classification of each item listed below by placing the letter of the correct balance sheet category a through g in the blank space next to the item.

Definitions:

Ownership

The legal right or title to an asset or property, implying control and responsibility over it.

Jelly

A food spread made from fruit juice and sugar, thickened with pectin, commonly consumed with bread.

Peanut Butter

A food paste or spread made from ground dry roasted peanuts, often used in sandwiches and as a base in various recipes.

Demand

The desire and ability of consumers to purchase goods or services at a given price level.

Q30: Based on the adjusted trial balance shown

Q36: Accrued revenues at the end of one

Q40: The matching principle does not aim to

Q48: Calculate the gross margin ratio for each

Q54: Revenues, expenses, and withdrawals accounts, which are

Q71: Adjustments are necessary to bring an asset

Q110: The amounts and timing of payment from

Q118: The four categories of equity accounts are

Q127: At the beginning of the year, a

Q186: A debit is used to record:<br>A) A