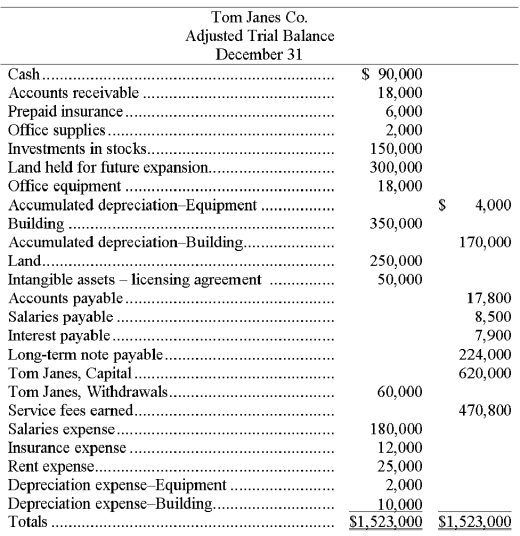

The following year-end adjusted trial balance is for Tom Janes Co. at the end of December 31. The credit balance in Tom Janes, Capital at the beginning of the year, January 1, was $320,000. The owner, Tom Janes, invested an additional $300,000 during the current year. The land held for future expansion was also purchased during the current year.

Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

2. Using the information presented:

(a) Calculate the current ratio. Comment on the ability of Tom Janes Co. to meets its short-term debts.

(b) Calculate the debt ratio and comment on the financial position and risk analysis of Tom Janes Co.

(c) Using the account balances to analyze the financial position of Tom Janes Co., why would the owner need to invest an additional $300,000 in the business when the business is already profitable and the owner had an existing capital balance of $320,000?

Definitions:

Industry Agreement

A collective consensus or a formal contract among companies within the same industry, often regarding standards, pricing, or other competitive practices.

Nonprice Competition

A marketing strategy in which a company tries to differentiate its product or service from competing products on the basis of attributes other than price.

Advertising

A method used by businesses to promote their products or services to potential customers.

Price Leadership

A market strategy where one leading company sets the price of goods or services within a sector, and other companies in the industry follow suit.

Q15: A company purchased new computers at a

Q49: Understanding generally accepted accounting principles is not

Q55: Reversing entries:<br>A) are necessary when journal entries

Q72: A buyer records the costs of shipping

Q82: A debit:<br>A) Always increases an account.<br>B) Is

Q88: How do closing entries for a merchandising

Q90: The aim of a post-closing trial balance

Q170: On May 1 of the current year,

Q182: Withdrawals by the owner are a business

Q194: Match the following definitions and terms by