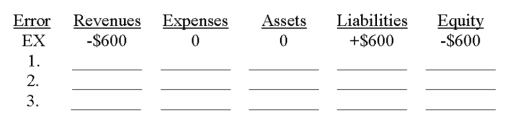

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Definitions:

Drawing

Drawing refers to the withdrawal of cash or other assets from a company by the owner(s) for personal use, decreasing the owner's equity in the business.

Decrease In Assets

A reduction in the value or amount of the assets owned by a company or individual.

Credit Balance

The amount of money that a company or individual has in their account, reflecting credits that exceed debits.

Salary Expense

This is the total amount paid to employees for services rendered during a specific period, typically reflecting wages or salaries before deductions.

Q40: Harriet's Toy Shop had net sales of

Q42: It is acceptable to record cash received

Q45: Explain why temporary accounts are closed each

Q56: A financial statement providing information that helps

Q68: The following transactions occurred during July: 1.

Q80: Owner financing refers to resources contributed by

Q96: A company issued financial statements for the

Q128: Closing entries are required at the end

Q167: The adjusted trial balance of Sara's Web

Q181: Cost of goods sold:<br>A) Is another term