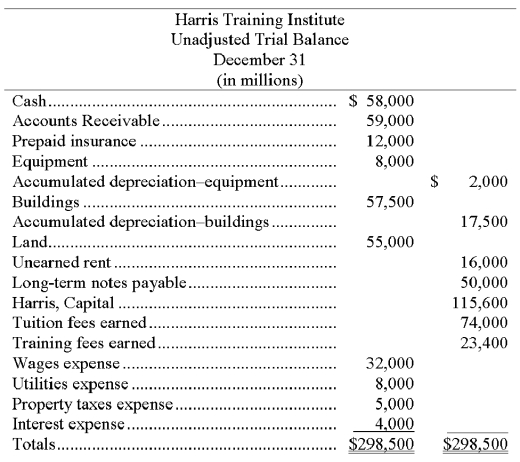

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. What is the impact of the adjusting entries on the balance sheet? Show calculation for total assets, total liabilities, and owner's equity without the adjustments; show calculation for total assets, total liabilities, and owner's equity with the adjustments. Which one gives the most accurate presentation of the balance sheet?

Additional information items:

a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Definitions:

Capital Decrease

A reduction in the amount of equity owned by shareholders or owners of a company, often resulting from losses or distribution of dividends.

Salary Allowances

Salary allowances are specific amounts designated in an individual’s salary package for purposes like housing, travel, medical expenses, etc., often with tax implications.

Partnership Income

The earnings generated by a partnership that are distributed to its partners according to their agreement.

Income Summary

An account used in the closing process that summarizes the revenues and expenses of an accounting period, to determine the net income or loss.

Q12: Neutron uses a periodic inventory system. Prepare

Q27: Which of the following is the formula

Q55: Reversing entries:<br>A) are necessary when journal entries

Q74: When closing entries are made:<br>A) All ledger

Q95: _ basis accounting means that revenues are

Q128: Before an adjusting entry is made to

Q138: The accrual basis of accounting:<br>A) Is generally

Q146: A record of the increases and decreases

Q180: Adjusting is a three-step process (1) _,

Q236: Match the following terms with the appropriate