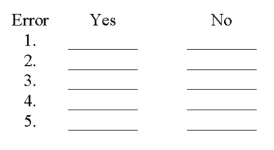

After preparing an (unadjusted) trial balance at year-end, G. Chu of Chu Design Company discovered the following errors:

1. Cash payment of the $225 telephone bill for December was recorded twice.

2. Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes Payable for $1,000.

3. A $900 cash withdrawal by the owner was recorded to the correct accounts as $90.

4. An additional investment of $5,000 cash by the owner was recorded as a debit to G. Chu, Capital and a credit to Cash.

5. A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

Using the form below, indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Definitions:

Variable

A quantity that can change or vary, often used in mathematics and statistical analysis as well as in economic models to represent changing economic indicators.

Fixed Cost

Costs that do not vary with the level of production or sales over a certain range, such as rent, salaries, and insurance.

Direct Materials

Direct materials are raw materials that are directly traceable to the manufacturing of a product and are a significant component of its cost.

Fixed Costs

Costs that remain constant in total regardless of changes in the level of activity or volume of production.

Q12: A company paid $9,000 for a six-month

Q28: Which of the following steps in the

Q80: On December 3, the Matador Company paid

Q81: Western Company had $500 of store supplies

Q83: _ are the increases in equity from

Q85: A liability created by the receipt of

Q126: Revenues, expenses, withdrawals, and Income Summary are

Q152: Accrued revenues at the end of one

Q158: Describe the types of entries required in

Q217: Generally accepted accounting principles are the basic