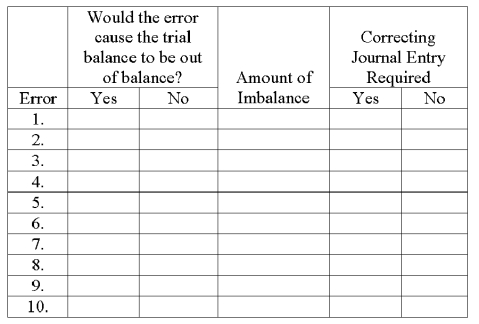

At year-end, Harris Cleaning Service noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 truck purchase was recorded as a $24,090 debit to Vehicles and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Harris was recorded as a debit to Del Harris, Capital and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal was recorded as a $100 debit to Del Harris, Withdrawal and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

Welfare Economics

A branch of economics that focuses on the optimal allocation of resources and goods and aims to evaluate the economic well-being of individuals and society.

Total Surplus

The sum of consumer surplus and producer surplus in a market, representing the total net benefits to all participants in the market transaction.

Demand Curve

A graphical representation showing the relationship between the price of a good or service and the quantity demanded by consumers at those prices.

Supply Curve

A graphical representation showing the relationship between the quantity of a good that producers are willing to sell and the price of the good.

Q17: Selective information processing is a major force

Q25: Match the following definitions with the terms

Q37: What are the various structural variables that

Q52: On February 5, Textron Stores purchased a

Q74: From the information provided, calculate Wooden's profit

Q98: Which of the following actions can extinguish

Q142: A company had revenues of $187,000 and

Q158: An account balance is:<br>A) The total of

Q170: A balance sheet that places the assets

Q179: Reston had income of $150 million and