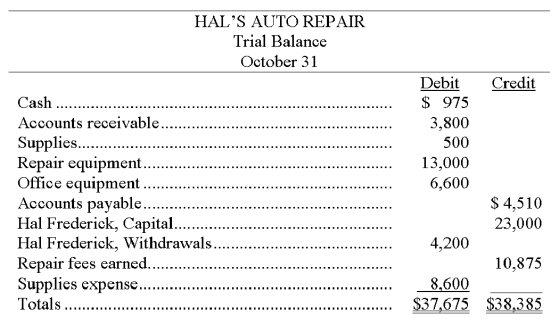

The following trial balance is prepared from the general ledger of Hal's Auto Repair.

Because the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

1. A purchase of supplies on account for $245 was posted as a debit to Supplies and as a debit to Accounts Payable.

2. An investment of $500 cash by the owner was debited to Hal Frederick, Capital and credited to Cash.

3. In computing the balance of the Accounts Receivable account, a debit of $600 was omitted from the computation.

4. One debit of $300 to the Hal Frederick, Withdrawals account was posted as a credit.

5. Office equipment purchased for $800 was posted to the Repair Equipment account.

6. One entire entry was not posted to the general ledger. The transaction involved the receipt of $125 cash for repair services performed for cash.

Prepare a corrected trial balance for the Hal's Auto Repair as of October 31.

Definitions:

Human Characteristic

Traits or features that are inherently part of being human, including biological, psychological, and social attributes.

Schooling

The process of receiving formal education, typically in an institutional setting such as a school.

Priming Method

A technique in psychology used to train people's memory both in positive and negative ways by presenting them with information that influences their subsequent actions or responses.

Implicit Memory

A type of memory that enables us to perform tasks without conscious awareness of these previous experiences.

Q6: Identify whether a debit or credit yields

Q8: The Unadjusted Trial Balance columns of a

Q13: Prior to recording adjusting entries, the Office

Q21: _ is addressed by asking the question,

Q44: The balance in Tee Tax Services' office

Q52: On February 5, Textron Stores purchased a

Q85: Company chants are examples of _.<br>A) rituals<br>B)

Q90: Based on the information in the example,

Q193: Increases in equity from a company's earnings

Q218: Zion Company has assets of $600,000, liabilities