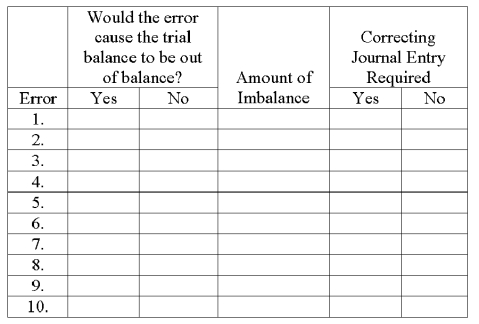

At year-end, Harris Cleaning Service noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 truck purchase was recorded as a $24,090 debit to Vehicles and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Harris was recorded as a debit to Del Harris, Capital and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal was recorded as a $100 debit to Del Harris, Withdrawal and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

Retaining Walls

Structures designed to restrain soil to unnatural slopes, preventing erosion and providing support.

Terraced Gardens

A series of graduated terraces providing flat areas for agriculture or aesthetic purposes on steep landscapes.

Doctrine of Part Performance

This doctrine refers to a legal principle that allows for the enforcement of an oral contract related to real property, provided there has been substantial performance by one party based on the agreement.

Hunting Cabin

A small, often rustic dwelling used as a base by hunters during hunting season.

Q12: The posting process is the link between

Q16: After preparing and posting the closing entries

Q61: Appreciative inquiry (AI) is an organizational development

Q91: The right inherent in a managerial position

Q104: Companies experiencing seasonal variations in sales often

Q117: What is the proper adjusting entry at

Q126: Revenues, expenses, withdrawals, and Income Summary are

Q144: _ and _ are the starting points

Q156: On June 30 of the current calendar

Q163: Flash had cash inflows from operations $62,500;