Which of the following is NOT a feature of the revised model of human evolution?

Definitions:

Marginal Tax Rate

The percentage of tax applied to your income for each tax bracket in which you qualify, essentially the rate at which the last dollar of income is taxed.

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

Fixed Costs

Costs that do not change with the level of production or sales activities within a certain range or period of time, such as rent, salaries, and insurance.

Contribution Margin

The amount remaining from sales revenue after variable expenses are deducted, indicating how much contributes to covering fixed costs and generating profit.

Q1: In the Issue-Contingent Model, the term "temporal

Q8: The AICPA's Code of Professional Conduct expresses

Q13: Under the Foreign Corrupt Practices Act, a

Q13: In Chapter 5, one of the examples

Q19: If an internal auditor discovers a suspected

Q22: Which of the following is a reason

Q23: When a person's net cash flow exceeds

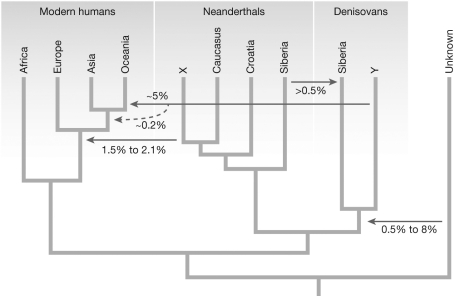

Q25: In this figure illustrating the ring species

Q27: Which of the following is NOT a

Q42: Describe the mutualistic interactions of the system